No one wants to think about his or her death, but a little preparation in the form of a prepaid funeral contract can be useful. In addition to helping your family after your death, a prepaid funeral contract can be a good way to spend down assets in order to qualify for Medicaid.

No one wants to think about his or her death, but a little preparation in the form of a prepaid funeral contract can be useful. In addition to helping your family after your death, a prepaid funeral contract can be a good way to spend down assets in order to qualify for Medicaid.

A prepaid or pre-need funeral contract allows you to purchase funeral goods and services before you die. The contract can be entered into with a funeral home or cemetery. Prepaid funeral contracts can include payments for: embalming and restoration, room for the funeral service, casket, vault or grave liner, cremation, transportation, permits, headstones, death certificates, and obituaries, among other things.

One benefit of a prepaid funeral contract is that you are paying now for a service that may increase in price—possibly saving your family money. You are also saving your family from having to make arrangements after you die, which can be difficult and time-consuming. And, if you are planning on applying for Medicaid, a prepaid funeral contract can be a way to spend down your assets.

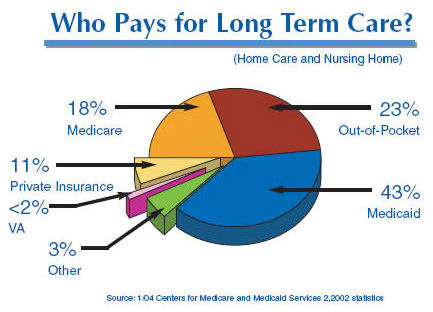

Medicaid applicants for benefits to pay for long term care, including a skilled nursing home, must spend down their available assets until they reach the qualifying level (usually around $2,000, depending on the state). By purchasing a prepaid funeral contract, you can turn “available assets” (that Medicaid attributes to you as funds available to pay for long term care) into an exempt asset that don’t count as available assets and won’t affect your eligibility. In order for a prepaid funeral contract to be exempt from Medicaid asset rules, the contract must be irrevocable. That means you can’t change it or cancel it once it is signed.

Before purchasing a contract, you should shop around and compare prices to make sure it is the right contract for you. Buyers need to be careful that they are buying from a reputable company and need to ask for a price list to make sure they are not overpaying.

For information from the Federal Trade Commission on shopping for funeral services, click here.

If we can assist you with determining whether you are eligible for Medicaid benefits to pay for long term care, or how to restructure your countable assets to below the $2,000 threshold so that you are eligible for Medicaid benefits, please give us a call. If all you need to qualify for Medicaid benefits is a qualified income trust, because your income is too high, then click here to prepare a qualified income trust (“Miller Trust”).